Australian Financial Review – James Eyers Senior Reporter

One of the pilots for a new digital Australian dollar will seek to compress the time it takes to settle trades in the $1.5 trillion bond market from two days to zero, removing settlement risks and cutting costs for banks and investors.

Imperium Markets is running one of the 14 pilots of a “central bank digital currency” (CBDC) announced last week by the Reserve Bank of Australia. Imperium, which received a tier 2 financial markets licence from ASIC in 2017 allowing it to create a market for debt securities, counts all the major banks as customers. They use the platform to manage debt issuance to institutional investors.

Imperium Markets CEO Stu Burns, left, with chairman Rod Lewis. “The banks customers want these efficiencies as well, and it is important the banks recognise that,” Burns says.

The RBA and Imperium will seek to prove that bonds and deposits, the main sources of funding for the economy, can be traded and settled instantly. This would be an improvement of current processes that see bonds held in escrow accounts for one or two days after a trade, to allow for payment and reconciliation of title between different accounting and technology systems.

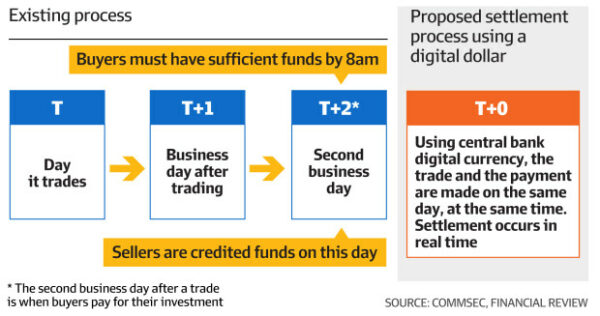

Essentially, this pilot could help shift debt securities settlement from “T+2” to “T+0”. It will involve banks buying CBDC through a digital wallet on the Imperium market, and using the digital currency to instantly pay for an asset at the time it is exchanged. This is known as “atomic settlement” and is one of the major advantages of moving markets onto blockchain systems.

“We will achieve atomic settlement of the issuance and trading of deposits, certificates of deposit, and floating rate notes,” said Imperium Markets chief executive Stu Burns. By delivering an asset and payment at precisely the same time (known as ‘delivery versus payment’), “all settlement and counterparty risk is removed”.

Shifting bond markets to real-time settlement would also safeguard Australian debt market liquidity, he said, as more global markets adopted digital currencies that would provide banks and other issuers, along with global investors, with alternative venues for lower-risk trading.

Fund managers could use T+0 settlement to slice reconciliation costs in the bank office, and also reduce various other costs charged by intermediaries, including central securities depositories, custodians and registries. It would let asset managers allocate capital more quickly.

“The banks’ customers want these efficiencies as well, and it is important the banks recognise that,” said Mr Burns, who worked for a decade at Westpac and Commonwealth Bank.

Freeing up funds

One of the attractive features for T+0 for banks would be reducing the amount of capital required to back existing settlement processes. These involve escrow accounts, against which banks hold funds in “exchange settlement accounts” at the RBA that earn no interest. If these funds were freed up, banks could earn more by lending them to business and households.

The size of the potential benefits for banks that could be realised from real-time settlement will be among additional topics to be studied by researchers at the Digital Finance Co-operative Research Centre (DFCRC), which is providing academic expertise to the RBA on the pilots, after it was seeded with $181 million in June 2021.

“The DFCRC will be looking at what are the dollar benefits of doing this. This is the biggest market that funds the economy, and there are definitely a lot of efficiencies up for grabs,” Mr Burns said.

Atomic settlement would also provide banks with more certainty in a financial crisis that the funds were available, and would reduce risk for investors if settlement failed and bond yields and prices moved during the settlement window.

As the European Central Bank, Sweden’s Riksbank and the Bank of England each move forward with their own studies of CBDC, Australia needs to keep pace or risks losing a proportion of the $750 billion in Australian corporate bonds – and a similar amount of government bonds – to offshore digital markets.

“There is a risk here that if we don’t do something the market shrinks. People say it could be five or 10 years [before CBDCs are widespread], but I think you will see digital bond issues in euro or sterling or yen sooner rather than later,” Mr Burns said.

“Once that happens, Australian banks will be issuing into those markets. Our major banks have been very good at being fast followers into new markets. If markets go digital, our investors and issuers could be out in other markets, so there is real danger of a money-drain in the main market funding the economy.”

Imperium chairman Rod Lewis spent 17 years at Commonwealth Bank, including as head of trading and before that, worked at Credit Suisse for almost a decade as head of fixed income trading.

The 14 RBA pilots will develop CBDC on a private version of the Ethereum blockchain, which is expected to be interoperable with other distributed ledger technology, including R3 Corda, which Imperium uses.

Among the 14 pilots announced by the Reserve Bank last week relevant to capital markets, ANZ and CBA will develop use cases for nature-based asset trading; the Australian Bonds Exchange will examine corporate bond settlement; Canvas Digital will develop tokenised foreign exchange settlement; digi.cash will look at custodial models; and Monoova will explore funds custody.

Read the full article