Imperium Markets

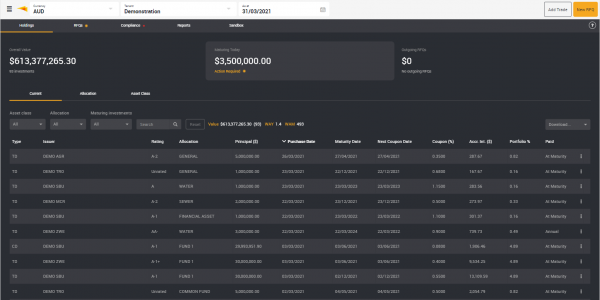

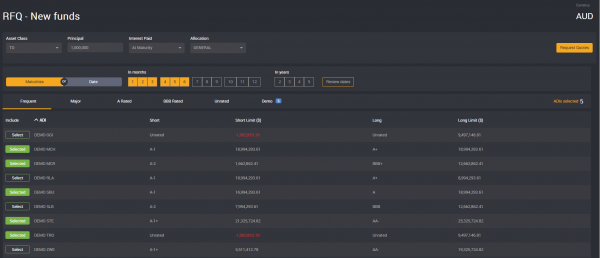

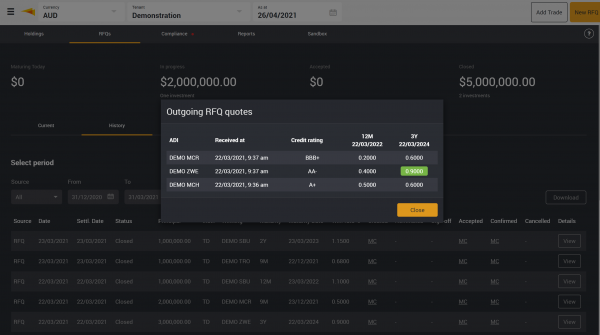

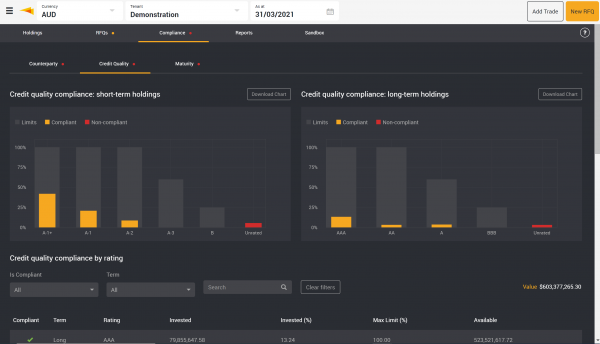

Digitising Money Markets and Fixed Income Securities

Imperium Markets is a financial and regulatory technology company with one clear vision: to digitise and transform the experience for Issuers and Investors in the money market and fixed income markets.